For decades shared ownership has been the answer for most young families, so why all of a sudden subtle decline?

This invites a closer exploration into the factors underpinning this trend. Data and numbers tell a story and this story doesn’t look so good for young growing families.

Beyond the numbers, persistent grievances about hidden fees and unforeseen financial obligations have begun to echo within the shared ownership sphere.

These concerns, often voiced by participants and prospective homeowners alike, emphasize the need for transparency and clarity in a model intended to empower individuals on their journey to property ownership.

Data over the past 10 Years

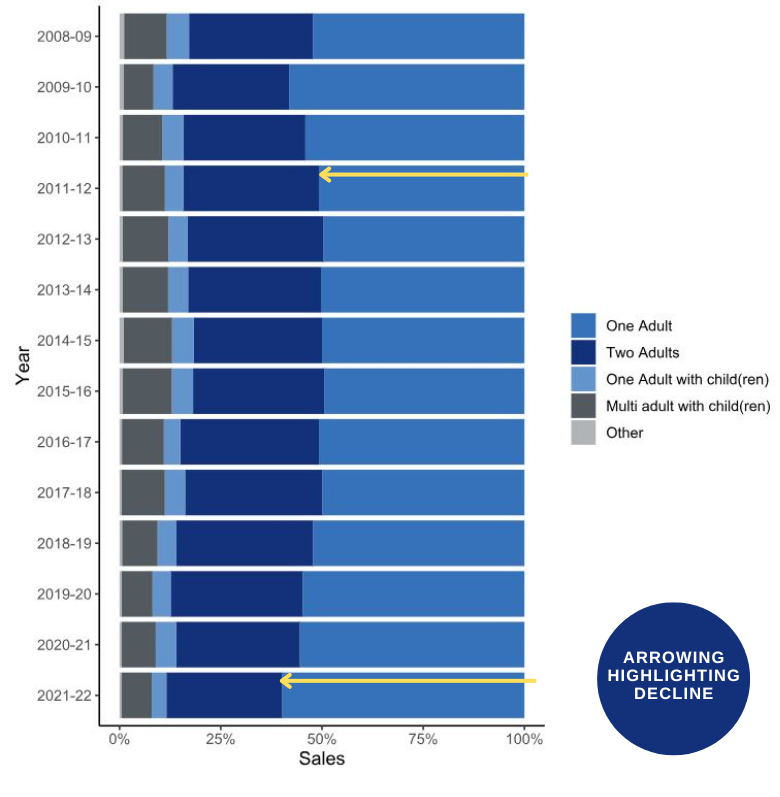

In 2021-22, an estimated 56% of purchases were made by one adult households, the highest proportion since 2010 whilst only 27% of purchases were made by households of 2 adults, a slight 15% decrease in the decade.

Data tells a story, and we see a slight decrease in 2 adult homeownership houses if we compare the numbers just 10 years ago.

Investigated by the Levelling Up, Housing Communities Committee

In response to the disappointment around shared ownership being accessible for families we have seen the scheme being further investigation

Clive Betts, Chair of the Levelling Up, Housing and Communities Committee said:

“Affordability of housing and home ownership is a key policy area, especially for first-time buyers during a cost-of-living crisis. Shared ownership has, in the past, been hailed as an answer to the housing crisis for younger people, offering the cheapest way to get on the housing ladder.

The investigation is to examine some of the barriers to homeownership through the Shared Ownership schemes in England and also look at issues such as the challenges faced by people in reselling these properties.

Disappointment from Shared Ownership Buyers

Various members of the scheme have taken to Twitter to share their disappointment with a common theme being Housing Associations demand their % share *of the RICS valuation* from the seller, even when the sale price is significantly lower.

While this not being about the fee it is certainly about the delta between the sold price and the valuation on the share the seller doesn’t own.

They have to cover that because the HA doesn’t take their share of the loss. In other words, it is added to the seller’s debt.

Some of the feedback can be seen here

This is not about the fee.

— Cladding Victim (@LostInSW19) December 7, 2022

It's a about the delta between the sold price and the valuation on the share the seller doesn't own. They have to cover that because the HA doesn't take their share of the loss. In other words, it is added to the seller's debt.

&

Very interesting #Panorama on shared ownership. Misleading in places tho. Many of the issues raised aren't exclusive to shared o'ship but faced by 'normal' leaseholders too.

— Sally Baker (@sallylbaker) November 25, 2020

More education needed for buyers on implications of leasehold/shared o'ship/service charges etc

The Common Theme affecting the scheme

Costly charges

While shared ownership can make the costs associated with buying and owning a home cheaper than buying the property outright there are various different costs that come with it which has been proven in our editorial.

Negative equity risk

Although house prices are still on the rise, some financial experts have warned of a possible crash on the horizon. Now that is not for definite, however its always something homebuyers should be wary off.

Selling difficulty

Buyers may find that when they are ready to sell their property, the process is a complicated one. If they do not own 100% of the property, the housing authority must be given the right to buy it through a process known as “first refusal”. This makes all the difference to the process.